- Analyzing the Key Components

- The Proposed Action Plan

- Portfolio Protection – Dump These 7 Stocks Now

- Shelter from Dollar Demise with Alternative Investments

- Invest in Indispensable Goods and Services

- Bonus #1: Long Oil – A Big Bet On Dirty Energy

- Bonus #2: Investing In America’s Infrastructure

- Bonus #3: Top Income Strategies For Cold Hard Cash

- The Essential Investor Member’s Forum

- The Essential Investor Model Portfolio

- Frequent Stock Recommendations

- Webinar-Based Updates

- The Essential Investor

- Evaluating the Offer

- Algo's Verdict

- TL;DR

- Popular Questions

- Glossary

- Pop Quiz

In an era of financial uncertainty, Addison Wiggin's latest offering, “The Great American Shell Game,” presents itself as a beacon for concerned investors.

This offers a thought-provoking analysis of the current state of the United States and forecasts potential crises.

Addison Wiggin, a seasoned financial analyst with The Essential Investor, confronts the harsh realities of the current American landscape in “The Great American Shell Game.”

Wiggin foresees three major crises converging by January 15, 2024:

- a banking collapse,

- the end of low-cost globalization,

- and political upheaval…

All of which pose a substantial threat to personal wealth.

He argues that these issues are creating a perfect storm, potentially leading to one of the most tumultuous periods since the 1960s.

Analyzing the Key Components

Banking Crisis

Wiggin predicts a banking crisis exacerbated by unstable banking practices and potential government overreach. He warns of several U.S. banks at risk of failure, reminiscent of the 2008 financial crisis.

Global Economic Shift

The promotion highlights the potential collapse of China's economy, a major player in the global market. This shift could end the era of cheap globalization, impacting global trade and the U.S. economy.

Political Turbulence

With the U.S. political landscape already strained, Wiggin anticipates further unrest, especially around the 2024 Presidential elections, which could lead to societal upheaval.

The Proposed Action Plan

Wiggin's “Protect and Profit Action Plan” is a three-step strategic approach designed to navigate these crises.

This plan is positioned as a comprehensive strategy to safeguard and potentially grow your investments amidst predicted economic and political crises.

Portfolio Protection – Dump These 7 Stocks Now

As part of a critical first step, Addison Wiggin emphasizes the urgent need to reevaluate your stock portfolio.

He identifies seven specific stocks, particularly in the banking and retail sectors, as high-risk investments poised for a downturn amidst the forecasted crises.

This step is akin to an insurance policy for your stock market investments, aimed at safeguarding your wealth from potential market catastrophes reminiscent of the dot.com and 2008 mortgage crises.

Shelter from Dollar Demise with Alternative Investments

In the second step, Wiggin advises diversifying into alternative investments that have historically shown resilience or growth when traditional markets falter.

This includes a strategic investment in gold through various means, such as direct ownership and income-generating funds and a measured approach to cryptocurrencies, emphasizing their potential surge during stock market downturns.

The focus is balancing your portfolio to mitigate risks and seek growth even in turbulent markets.

Invest in Indispensable Goods and Services

The third step revolves around investing in crucial sectors regardless of economic conditions.

Wiggin spotlights energy, particularly an ultimate energy stock poised for significant growth, and AI data companies, which are integral to the continued development of AI technology.

These investments are designed to offer long-term growth, income, and profit opportunities, even in the face of global economic challenges.

These additional dossiers provide insights into specific sectors likely to yield substantial profits during the crises, offering an edge in a challenging economic environment.

Bonus #1: Long Oil – A Big Bet On Dirty Energy

Focus: This report delves into the potential resurgence of traditional energy sources, specifically oil, in response to market turmoil and crises.

Key Insights: It discusses strategic investments in oil and gas producers, which are expected to benefit from rising oil prices, particularly as they soar over $100 a barrel.

This dossier positions oil as a lucrative investment and a hedge against dollar devaluation.

Bonus #2: Investing In America’s Infrastructure

Focus: This dossier explores investment opportunities arising from the U.S. government's trillion-dollar commitment to infrastructure development.

Key Insights: It highlights companies positioned to secure lucrative contracts in this large-scale national project, covering sectors from transportation infrastructure to digital and water systems, offering potential substantial returns for investors.

Bonus #3: Top Income Strategies For Cold Hard Cash

Focus: The report centers on establishing reliable income streams, which is crucial during economic uncertainties.

Key Insights: It provides strategies for setting up consistent and robust cash-generating investments. These could range from dividend stocks to other income-generating assets designed to offer financial stability and regular cash flow amidst market volatility.

Subscribers are offered bonus reports focusing on oil investments, American infrastructure, income strategies, and access to a member's forum and regular webinars.

The Essential Investor Member’s Forum

Gain access to a members-only forum. This is a space where you can connect with other like-minded investors, share ideas, and seek answers to pressing investment questions.

Such communities are invaluable, especially in volatile times, providing a platform for exchange and learning.

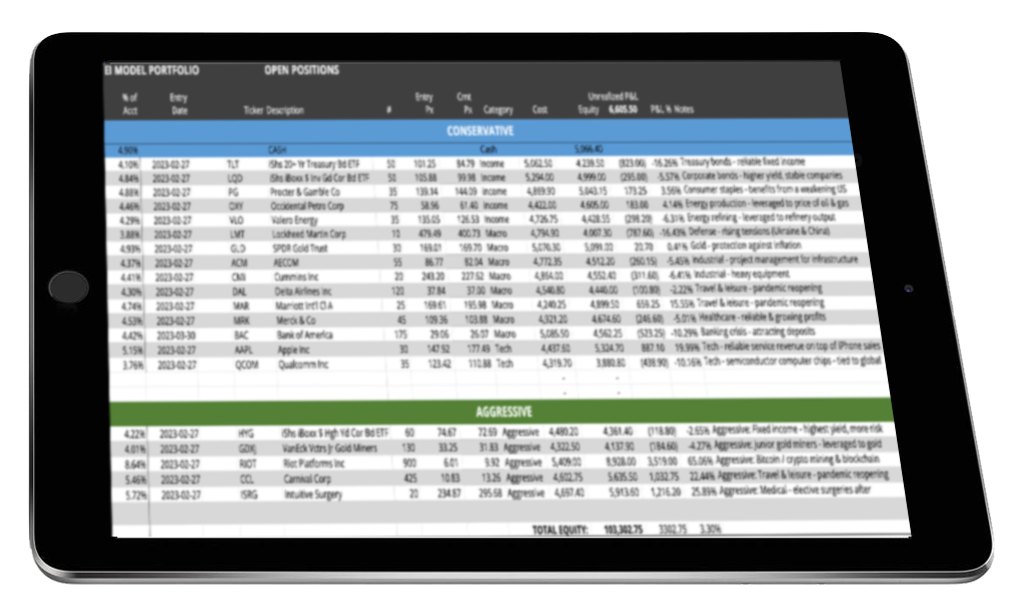

The Essential Investor Model Portfolio

This feature represents a balanced investment approach, blending wealth-preservation assets with speculative opportunities.

It advocates for a diversified investment strategy, allowing subscribers to tailor their portfolios to their individual risk tolerance and financial goals.

Frequent Stock Recommendations

Subscribers receive up to two new stock plays every week.

This service aspect is particularly valuable for those who prefer a more hands-on, dynamic approach to their investment strategy.

Webinar-Based Updates

Webinars offer subscribers a platform to engage directly with experts like Addison Wiggin, allowing for a two-way exchange of information.

For subscribers of “The Great American Shell Game,” participating in these webinars could enhance their understanding of the proposed strategies and their application in different market conditions.

The Essential Investor

“The Essential Investor” subscription offers a comprehensive suite of resources, making it a potentially valuable tool for those looking to navigate the complex landscape of financial investing.

With the addition of regular stock recommendations, a members' forum, monthly webinars, and dedicated customer service, this service goes beyond mere financial advice.

It endeavors to create a well-rounded, interactive, and educational experience for its subscribers.

Evaluating the Offer

The potential crises outlined by Wiggin are grounded in current economic and political observations, but they are, after all, forecasts subject to change.

Risk Awareness: The promotion's depiction of imminent crises warrants a careful approach. Economic forecasting is complex and uncertain, and while preparedness is key, so is skepticism toward alarmist predictions.

Diversification and Research: The proposed investments, particularly in alternative assets, should be a part of a more diversified portfolio. Independent research is crucial in validating any investment decision.

Understanding the Commitment: Before subscribing to “The Essential Investor,” ensure you know the subscription's long-term commitments and costs.

Algo's Verdict

“The Great American Shell Game” offers a stark view of future challenges facing the U.S. economy and political system.

While the promotion outlines a specific strategy for weathering these potential crises, it's crucial to remember that investment is inherently risky, and diversification remains a key tenet of sound financial planning.

Investors should cautiously approach the predictions and strategies, ensuring they align with their individual risk profiles and investment goals. Diversification, independent research, and a keen eye on market trends remain the pillars of successful investing.

For those keen to further explore Addison Wiggin's insights and recommendations, “The Great American Shell Game” might offer valuable perspectives. Remember, informed decisions are the bedrock of successful investing.

TL;DR

“The Great American Shell Game” by Addison Wiggin presents a strategic approach to navigating potential economic and political crises in the U.S. by January 2024. It offers a three-step action plan focusing on divesting from high-risk stocks, investing in gold and cryptocurrencies, and focusing on essential sectors like energy and AI. Wiggin's “The Essential Investor” subscription provides additional insights and stock recommendations.

Popular Questions

Here are some popular questions about this offer.

What is ‘The Great American Shell Game' by Addison Wiggin About?

‘The Great American Shell Game' is a financial strategy guide by Addison Wiggin. It addresses the convergence of three major crises in the U.S. – a banking crisis, the end of cheap globalization, and political upheaval – and offers a detailed action plan to protect and potentially profit from these challenges.

How Can Investors Protect Their Portfolio According to ‘The Great American Shell Game'?

Investors can protect their portfolio by following Wiggin's three-step action plan: 1) Divesting from seven specific high-risk stocks, particularly in the banking and retail sectors. 2) Investing in alternative assets like gold and cryptocurrencies as hedges against the dollar's decline. 3) Investing in essential services and technologies, like energy and AI.

Is the ‘The Essential Investor' Subscription Worth It?

The ‘The Essential Investor' subscription offers regular stock recommendations, investment advice, and access to special reports by Addison Wiggin. It could be valuable for those seeking detailed guidance in navigating the forecasted economic and political turmoil. However, it's important to understand the subscription terms and ensure they align with your investment goals and risk profile.

What Are the Risks Involved in Following ‘The Great American Shell Game'?

The risks involve potential market volatility, political uncertainty, and the inherent risks of investing in alternative assets like cryptocurrencies. Diversification and independent research are essential to mitigate these risks.

Where Can I Find Customer Service for ‘The Great American Shell Game'?

For customer service related to ‘The Great American Shell Game,' contact Money Map Press, LLC. Their customer service can be reached at 1-888-384-8339 or 1-443-353-4519 for international callers, available Monday through Friday, 8 a.m. to 5 p.m. (ET).

Glossary

Here is a glossary with key terms mentioned in this article.

Certainly! Here's a glossary for key terms mentioned in the transcripts, formatted as requested:

The Great American Shell Game: A financial strategy guide by Addison Wiggin that addresses potential economic and political crises in the U.S., offering a plan for investors to protect and potentially profit from these challenges.

Addison Wiggin: A financial analyst and author known for identifying and tracking financial crises and the creator of “The Great American Shell Game.”

Banking Crisis: A financial crisis occurs when many banks suffer simultaneously from significant losses, leading to a lack of liquidity and failure to operate effectively.

Globalization: The process by which businesses or other organizations develop international influence or start operating on an international scale. In the context of the transcripts, it refers to the economic interdependence of countries.

Political Turmoil: A state of significant disturbance, confusion, or uncertainty within a government or country, often leading to social unrest or changes in leadership.

Action Plan: A detailed strategy or course of actions proposed to achieve specific goals. In this context, it refers to the steps suggested by Wiggin to navigate through economic and political crises.

Investment Portfolio: A collection of financial investments like stocks, bonds, commodities, cash, and cash equivalents, including mutual funds and ETFs.

Cryptocurrencies: Digital or virtual currencies that use cryptography for security and operate independently of a central bank.

Gold: A precious metal used as a standard for monetary policies and an investment to hedge against inflation and currency devaluation.

AI (Artificial Intelligence): The simulation of human intelligence processes by machines, especially computer systems. These processes include learning, reasoning, and self-correction.

The Essential Investor: A subscription-based financial research service by Addison Wiggin that offers stock recommendations, investment advice, and special reports.

Diversification: A risk management strategy that mixes various investments within a portfolio to reduce the impact of any single asset's performance on the overall portfolio's returns.

Market Volatility: The rate at which the price of a security or market index increases or decreases for a given set of returns. It is typically measured by the standard deviation of the annual return over a period of time.

Pop Quiz

Understanding “The Great American Shell Game”

01.) What does “The Great American Shell Game” primarily address?

A. Investment in technology stocks

B. Global warming and environmental issues

C. Economic and political crises in the U.S.

D. Strategies for real estate investment

02.) Which sector does Addison Wiggin suggest as a high-risk investment in the current climate?

A. Technology

B. Healthcare

C. Banking and retail

D. Agriculture

03.) What alternative asset does Wiggin recommend to hedge against the dollar's decline?

A. Real estate

B. Bonds

C. Gold and cryptocurrencies

D. Commodities

04.) What is the primary focus of “The Essential Investor” subscription service?

A. Providing legal advice on financial matters

B. Regular stock recommendations and investment advice

C. Personal finance and budgeting

D. News updates on global economics

05.) What is a crucial strategy suggested by Addison Wiggin for portfolio protection?

A. Investing heavily in a single stock

B. Focusing only on short-term trading

C. Divesting from certain high-risk stocks

D. Ignoring market trends and analyses

Answer Key:

C, 2. C, 3. C, 4. B, 5. C